Providing Real-Time Analysis to 11M Customers

DSE gives Mint the power to change information in their supporting systems into actionable insights with historical views into account statuses, which was previously impossible with relational technologies.

Products & Services

DataStax EnterpriseIndustry

Financial Services & Insurance

Location

Palo Alto, CA

15 TB

of transactional data in DSE

21 nodes

in a single cluster

Real-time

analysis of information for improved customer experience

15 TB

of transactional data in DSE

21 nodes

in a single cluster

Real-time

analysis of information for improved customer experience

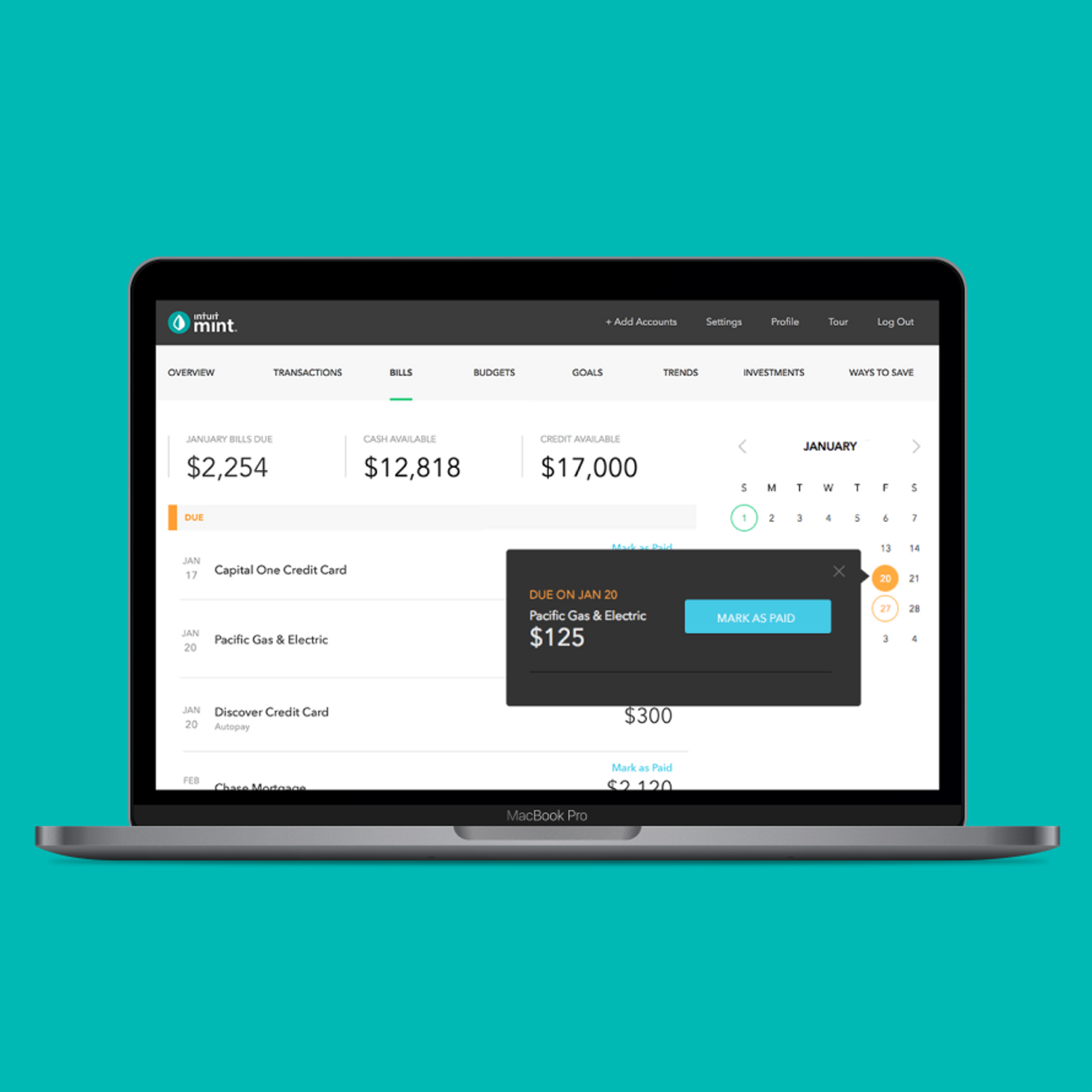

DSE gives Mint the power to change information in their supporting systems into actionable insights with historical views into account statuses, which was previously impossible with relational technologies. Mint Bills (formerly known as Check) is a top-rated, award-winning mobile app that takes the work and worries out of paying bills for more than 11 million U.S. consumers. The Mint Bills application stays on top of people’s bills and money, eliminating missed payments, overdrafts, and late fees. Launched in 2008, Mint Bills was one of the initial 500 apps released on the first generation iPhone. The company was acquired by Intuit Inc. for $360 million in June 2014.

Challenge

In the financial services sector, it is extremely challenging to get traction against established mega leaders and stand out as a disruptor. Mint Bills is a top mobile app focused on bill payments and personal financial management, helping users manage and track bills quickly and efficiently. With a few taps, users get an easy-to-understand overview of their bills, credit cards, bank balances, and investment accounts, all in one place. The application also sends timely bill reminders coupled with mobile payment functionality, making Mint Bills a one-stop destination for everyday personal finance.

With more than 11 million users, Mint Bills faced the challenge of aggregating exponentially growing amounts of user data while delivering application performance in real-time. Previously, Mint Bills relied on MySQL as a primary data store but soon hit the ceiling with scale and performance. Relational database architectures do not scale easily or predictably with massive data volumes and dynamic data models inherent in user data from different bank accounts, investment accounts, and billers. Furthermore, Mint Bills’ relational model could not keep up with the performance needs of the online application supporting concurrent users viewing account information and retrieving payment results in real-time.

To deliver the best possible customer experience, Mint Bills realized that it needed a powerful technology approach for its database infrastructure. It also needed a fast and reliable way to aggregate user information daily and analyze and keep track of information like the number of credit cards and bills, even from previous weeks. These requirements led to Mint Bills’ search for a platform that offered seamless Hadoop integration, with the power to merge and analyze transactional with historical information for accurate business insights.

Solution

When Mint Bills began its search, relational databases were ruled out because of their inability to cost-effectively scale for immense volumes of data along with performance, complexity, and latency issues. “Our first decision was not to store user account data in a relational way,” said Micky Csasznik-Shaked, technology lead at Mint Bills. “Because of the large number of data models we had, to get a full view of all information across user accounts meant that we would have to join numerous tables and make many calls to the database, thus bringing down application performance.” Another problem Mint Bills faced was with relational databases' inability to save more than current results, limiting the understanding of customer profiles.

To meet the needs for scalability and real-time performance, Mint Bills selected Apache Cassandra to store user account data. “When you are selecting between accounts on your Mint Bills app, you are retrieving information from Cassandra directly,” Csasznik-Shaked added.

Mint Bills migrated to DataStax Enterprise for enterprise production support and professional services. Since Mint Bills is a financial services company it sets a high bar for database security, and DataStax Enterprise was able to deliver that with Mint Bills’ private data infrastructure. As a mission-critical application, Mint Bills relies on the Cassandra experts and 24x7 support provided by the DataStax team.

Results

Currently, Mint Bills have 21 nodes in one cluster and stores 15 TB of transactional data in DataStax Enterprise. Even with a fast-growing number of users and accounts across various types of data models, Mint Bills continues to perform and scale with ease to support this massive growth. DataStax Enterprise has helped Mint Bills unlock valuable insights found in their Hadoop data lake, allowing them to integrate historical offline data with transactional online data. Mint Bills has extended its solution from mobile to a web

Mint Bills have 21 nodes in one cluster and stores 15 TB of transactional data in DataStax Enterprise

application. Mint Bills’ award-winning app is recommended by the media as an outstanding personal finance tool and the leading mobile bill payment solution. The company continues to grow its partner network including financial institutions, regional utility providers, and communications carriers to provide superior user experiences to customers. Its huge success caught the eye of Intuit, who subsequently acquired the company for $360 million in June 2014.

DataStax Enterprise gives us the power to change information in our supporting systems into actionable insights with historical views into account statuses, previously impossible with relational technologies. With Apache Cassandra and DataStax Enterprise as our database infrastructure, we can scale and give our users a real-time, engaging customer experience.